ISO Rating

The Statesboro Fire Department is proud to have achieved a Class 2 ISO Rating for the City of Statesboro and the surrounding Fire District.

If a fire should occur, the Statesboro Fire Department would respond with 3 engines, an aerial, and a water tanker. Each engine carries 1000 gallons of water, the aerial carries 500 gallons, and the tanker has a 3000 gallon capacity. If needed, the department can dispatch additional engines and a service apparatus that carry additional tools and water to the scene. The department has 20 firefighters on shift each day.

Your area’s ISO fire score is a rating that determines how well your local fire department can protect your community and home. Insurance companies use the score to help set home insurance rates, as a home that is less likely to be severely damaged or destroyed by fire is cheaper to insure. However, the impact of your area’s ISO score on your homeowner’s insurance policy varies by insurer.

A company called the Verisk ISO (Insurance Services Office) creates ratings for fire departments and their surrounding communities. The ratings calculate how well-equipped fire departments are to put out fires in that community. The ISO provides this score, often called the “ISO Rating,” to homeowners insurance companies. The insurers then use it to help set homeowners’ insurance rates. The more well-equipped your fire department is to put out a fire, the less likely your house is to burn down. This makes your home less of a risk, and therefore less expensive, to insure. The Statesboro Fire Department undergoes an ISO evaluation periodically, as stipulated in Chapter 120-3-20 of the Rules and Regulations of the Safety Fire Commissioner.

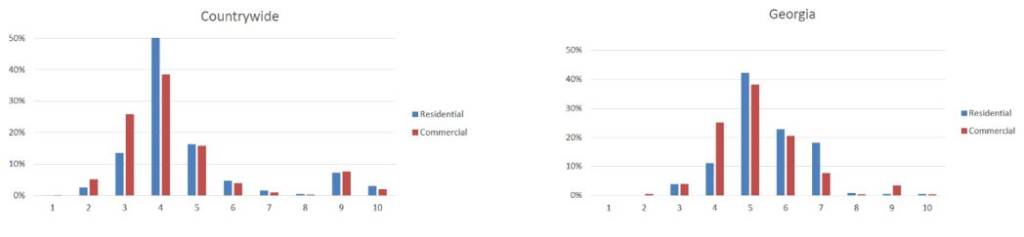

An ISO fire insurance rating also referred to as a Fire Protection Rating (FPR) or Public Protection Classification (PPC), is a score from 1 to 10 that indicates how well-protected your community is by the fire department. In the ISO rating scale, a lower number is better: 1 is the best possible rating, while a 10 means the fire department did not meet the ISO’s minimum requirements.

According to the ISO’s Fire Suppression Rating Schedule (FSRS), there are four main criteria to a fire rating score:

- 50% comes from the quality of your local fire department including staffing levels, training, and proximity of the firehouse.

- 40% comes from the availability of water supply, including the prevalence of fire hydrants and how much water is available for putting out fires.

- 10% comes from the quality of the area’s emergency communications systems (911).

- An extra 5.5% comes from community outreach, including fire prevention and safety courses.

- Any area that is more than 5 driving miles from the nearest fire station is automatically rated a 10.

It is possible to get a maximum score of 106% on the survey, although any fire department that scores above 90% receives the highest ranking, a 1. Very few fire departments receive that ranking–only 0.71% of all communities surveyed have a 1. The Statesboro Fire Department current holds the score of 86, only 4 points short of this prestigious rank.

A rating of 5 is both the median and most common rating fire departments received. In general, urban areas tend to have better FPR or PPC scores than rural areas, as urban fire departments are closer together and often receive better funding.

The formulas homeowners insurance companies use to determine their insurance rates are complex and constantly changing. But, all other things being equal, a lower FPR or PPC score for your area will translate to a lower homeowners insurance premium, as it means your home is at a lower risk for severe fire damage. Home insurance companies offer lower rates if you have a good ISO rating because a well-prepared fire department should be able to put out your home’s fire more quickly.

However, how your rating impacts your homeowners insurance premium varies by insurer, and it’s often only one of many factors considered with regard to fire safety. For example, some companies will ask about your home’s proximity to a fire station or fire hydrant, as well as whether you have a fire alarm or sprinkler system. Others do not use ISO scores to set homeowners premiums at all. Instead, they use their own metrics based on factors like historical fire data.

With that in mind, if your homeowners insurance premiums have increased due to a negative ISO fire rating, or you’re no longer able to obtain home insurance at all, you may be able to bring your costs back down by shopping around for the best homeowners insurance company for your needs.

If your area has a poor fire score, it’s a good idea to take extra steps to fireproof your home, like installing a sprinkler system or smart smoke alarms. Many insurance companies provide discounts to homeowners who take extra steps toward fire prevention, which may help you offset increased insurance costs. Most importantly, your home will be safer and better protected from fire damage.